Is your organization prepared to take advantage of the simplicity, variety, and cost savings offered by online marketplaces like Amazon and Alibaba? Originally consumer-focused, these marketplaces are now poised to disrupt B2B business.

The 2020 COVID-19 pandemic has changed many things about daily life including, notably, consumer shopping habits. There is an expected 15-30% growth in consumers purchasing online in many categories post-COVID, according to a recent McKinsey survey. B2B transactions have not seen this same dramatic increase, but could a shift be on the horizon?

Although B2B online marketplaces haven’t been as widely adopted by large corporate procurement departments as B2C purchasing has been by consumers, 40% of the workforce is now millennial or younger and these employees’ experience and comfort with online marketplaces could change buying behaviors in the coming years. The 2020 CAPS Research report, Online Marketplaces and Procurement, details the current landscape of B2B online marketplaces and projections for future use.

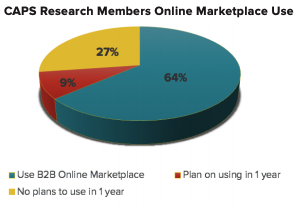

A new generation of procurement leaders are beginning to see the inherent benefits of sourcing within online marketplaces. CAPS polled CPOs for this research project, showing that 64% had already begun using online marketplaces and another 9% had no plans to use them within the next year.

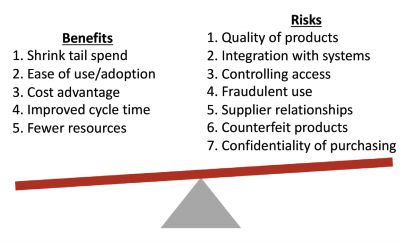

The main reasons for online marketplace adoption were convenience, increased choices, and better visibility on spending. These numbers and benefits are reflected in the reported revenues for Amazon Business, a very new business with huge growth. Amazon Business launched in 2015 and recorded $1B in revenue its first year, surpassing $10B in 2019.

Most companies referenced in the Online Marketplaces and Procurement report said they were currently using online marketplaces for indirect items like MRO products, as these items can fluctuate in price and availability and have a more dynamic pool of suppliers that can provide better opportunities for savings. Their indirect spend with online marketplaces was less than 5% but that was expected to double within the next five years.

While relationships and sourcing for direct materials can be more complex and time-consuming, requiring large quantities, discounts, quality, and delivery guarantees (among countless other criteria), researchers say direct materials procurement will slowly migrate to online marketplaces as the platforms evolve and develop.

There are some inherent risks that will need to be reviewed and mitigated if companies plan to transition to online marketplaces for direct materials, including potential for reduced quality and counterfeit. The 2019 CAPS Research report, Counterfeiting in the Supply Chain, notes a rise in counterfeit products due to an increase in e-commerce sales, making it difficult to track product origin. Not surprisingly, Alibaba, a China-based online marketplace with a 100% increase in U.S. business transactions in 2020, is referenced in the research report as being at-risk for carrying counterfeit materials. The other risks mentioned by CPOs, along with the benefits of online marketplaces, are shown in the table at right.

The report includes an audit of the 44 U.S.-based marketplaces, noting the unique business features of each. Mobile access (convenience), data/spend analytics, and background verification or authentication are the three most offered features, aligning with the top priorities listed by CPOs.

__________________________________

Online Marketplaces and Procurement includes a roadmap for online marketplace adoption and a review of the impact on roles, skills, and technology, and is available to employees of CAPS member companies in the CAPS Library now.

Members get priority access

Explore the entire CAPS Lbrary

Reports published in the last four years are reserved for CAPS members, but anyone may create a complimentary account and access more than 30 years of reports. If you'd like to read this report now, please consider CAPS Research membership for your supply management organization.

Non-members can receive the report of each survey they submit.

Members can access all reports, but are encouraged to submit surveys to

increase the comparative breakouts only they receive.