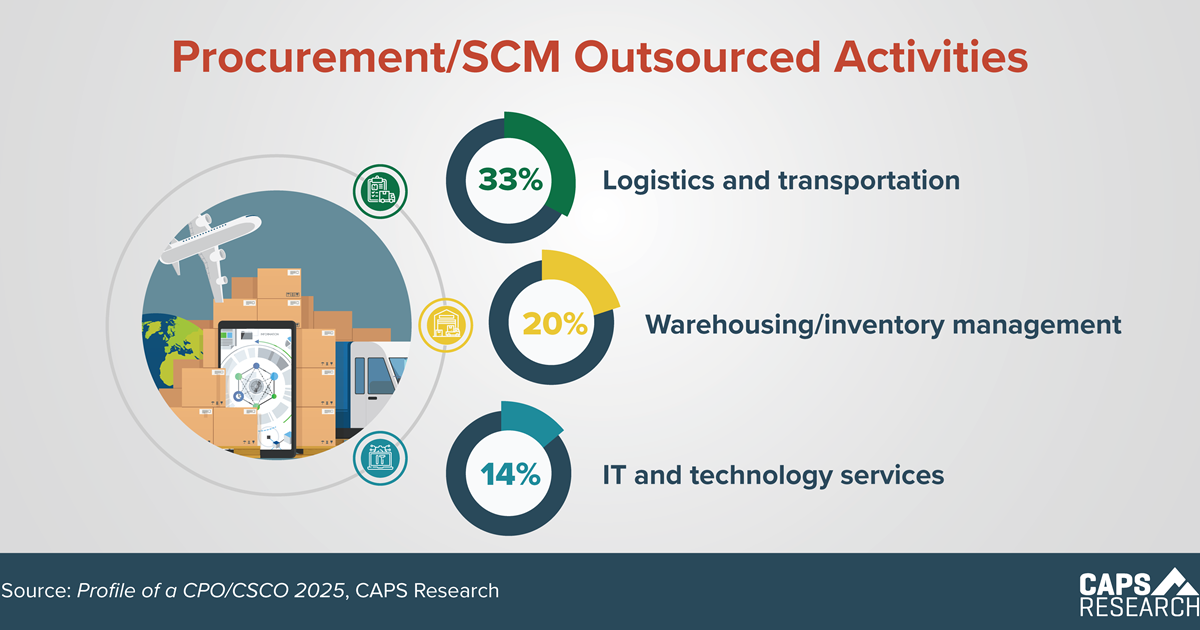

Procurement/SCM leaders currently outsource various services to third-party providers, partially or entirely. 33% outsource logistics and transportation, followed by 20% who outsource warehousing/inventory management and 14% for IT and technology services. Outsourcing select supply chain functions to specialized partners enhances operational efficiency, ensures access to cutting-edge technology and expertise, and enables procurement and SCM teams to concentrate on driving strategic value and long-term competitive advantage.

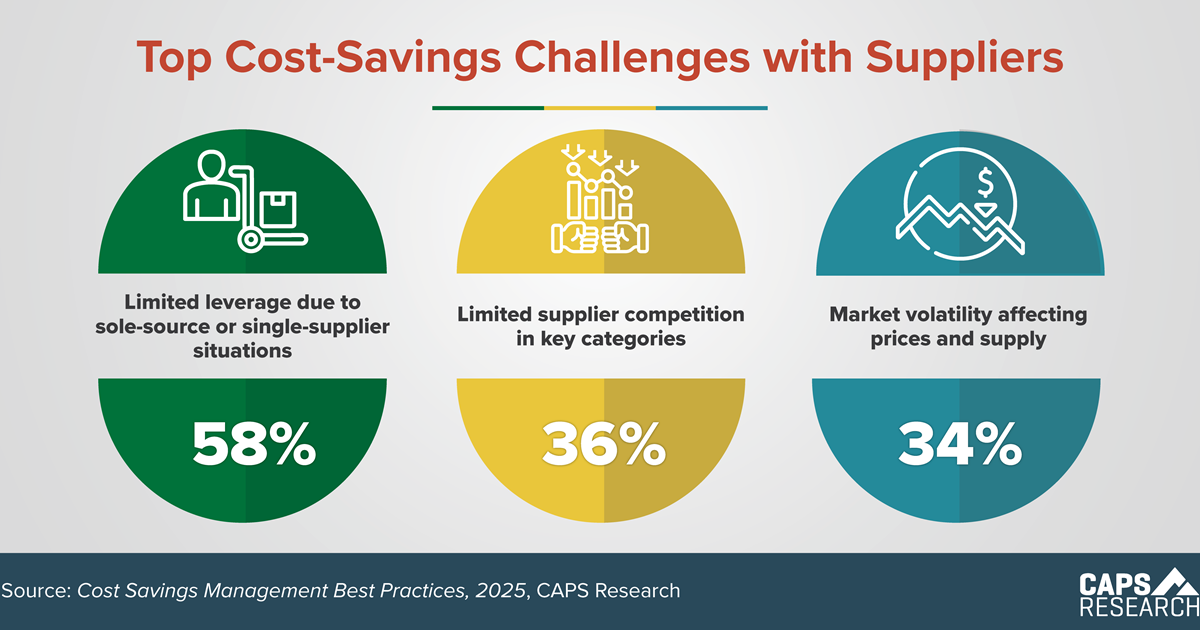

Cost-Savings Challenges

Top challenges Procurement/SCM organizations face with suppliers that affect achieving cost savings include, limited leverage due to sole-source or single-supplier situations, limited supplier competition in key categories and market volatility affecting prices and supply. By proactively addressing these challenges organizations can strengthen their negotiating power, stabilize supply and pricing, and unlock meaningful cost savings, ultimately boosting resilience and competitiveness.

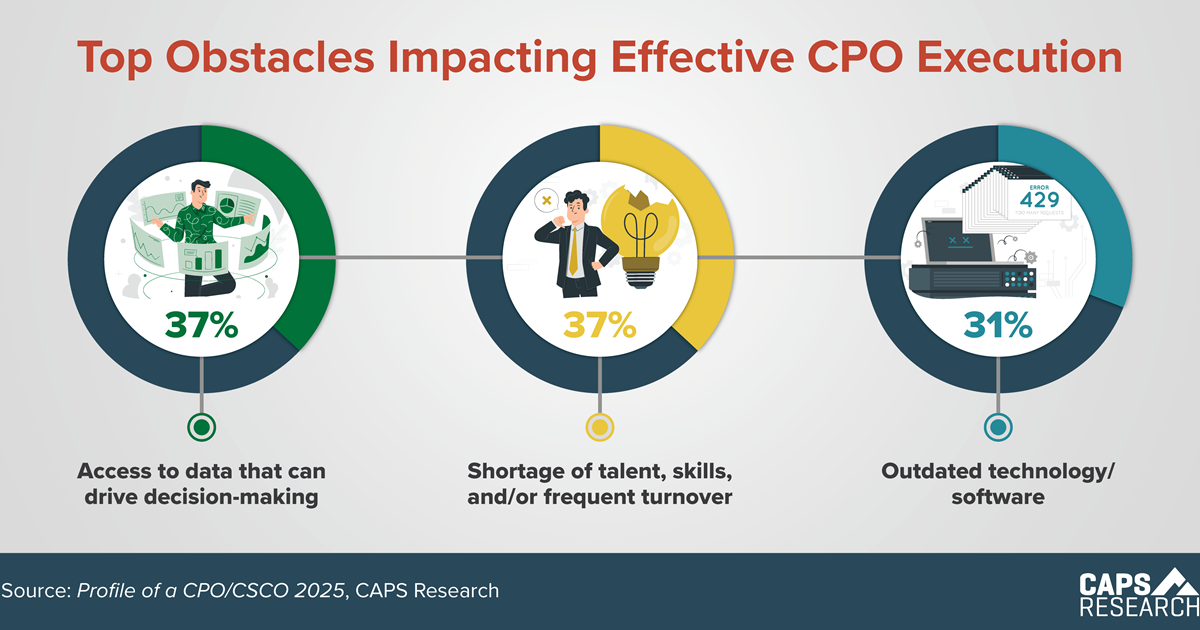

Obstacles Impacting CPO Execution

Procurement/SCM leaders report top obstacles that impact their ability to effectively execute their roles are access to data that can drive decision-making (37%), a shortage of talent, skills, and/or frequent turnover (37%), and outdated technology/software (31%). Removing these obstacles improve operational efficiency, enhance competitiveness, and sustain long-term growth.

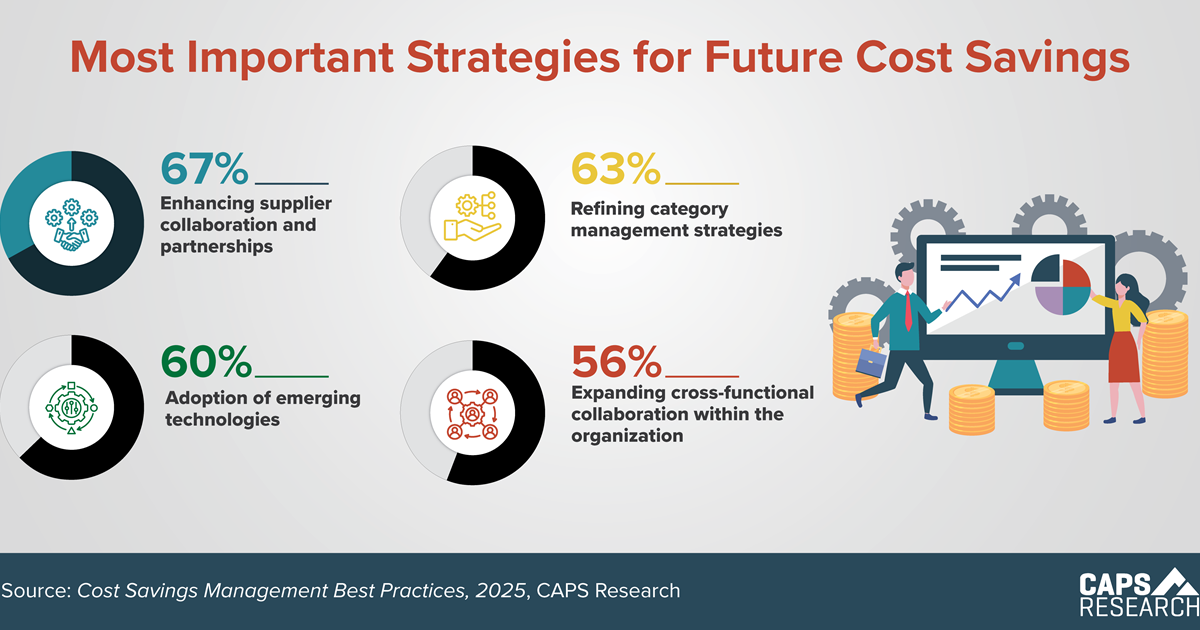

Strategies for Cost Savings

Procurement/SCM leaders consider enhancing supplier collaboration and partnerships, along with refining category management strategies to be strategically important for future cost savings. These are closely followed by adoption of emerging technologies and expanding cross-functional collaboration within the organization. Using these strategies can unlock significant cost-saving opportunities, boost operational efficiency, and contribute to overall organizational success.

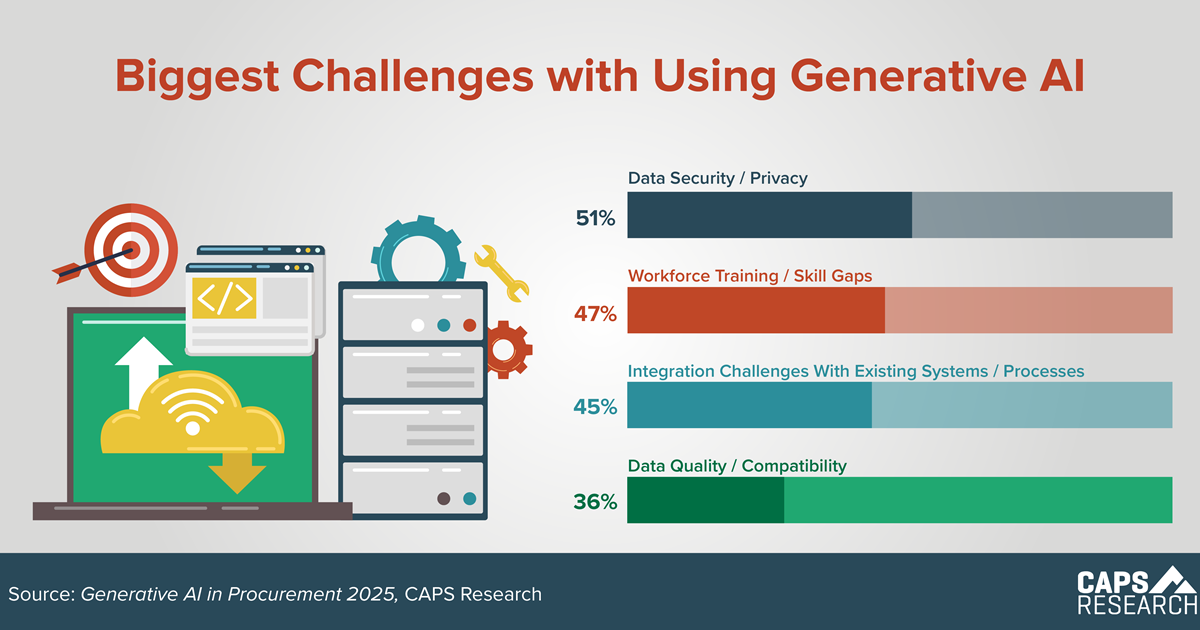

Generative AI Challenges

While Generative AI use is increasing in supply chain, it is not without its challenges. The biggest challenges include data security/privacy; workforce training/skill gaps; integration challenges with existing systems/processes; and data quality/compatibility. As solutions to these challenges are discovered, the use of Generative AI is expected to increase.

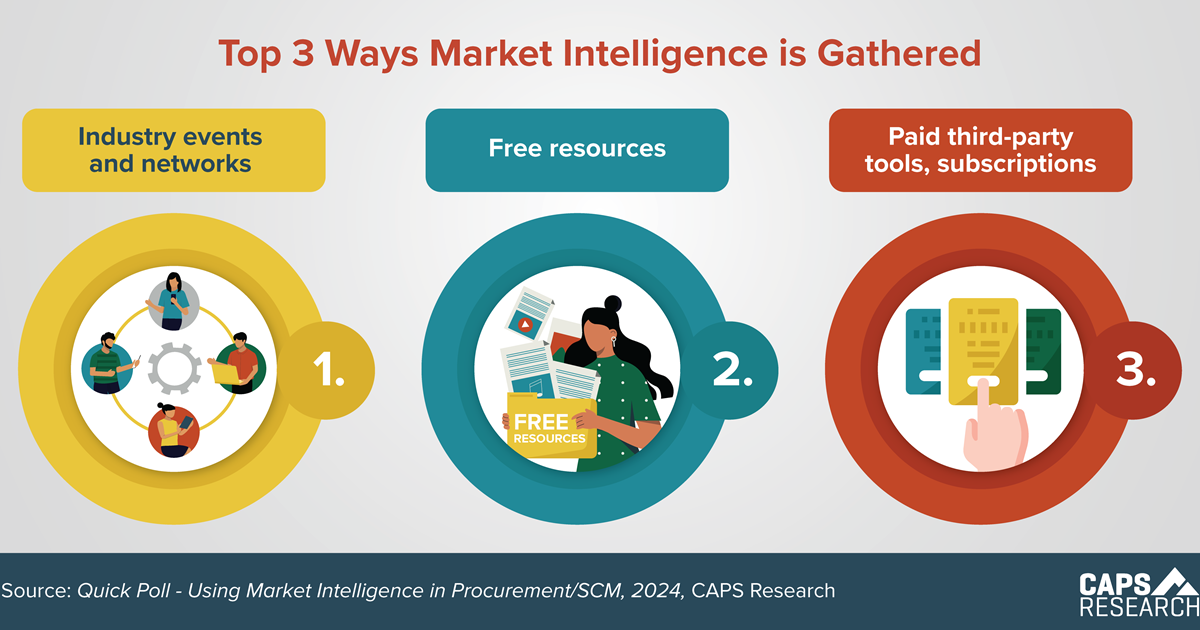

Gathering Market Intelligence

According to a recent CAPS quick poll, the top 3 ways a procurement/SCM team gathers market intelligence is through industry events and networks; free resources; and from paid third-party tools and subscriptions. Effective market intelligence is a key tool for reducing supply chain costs and risks.

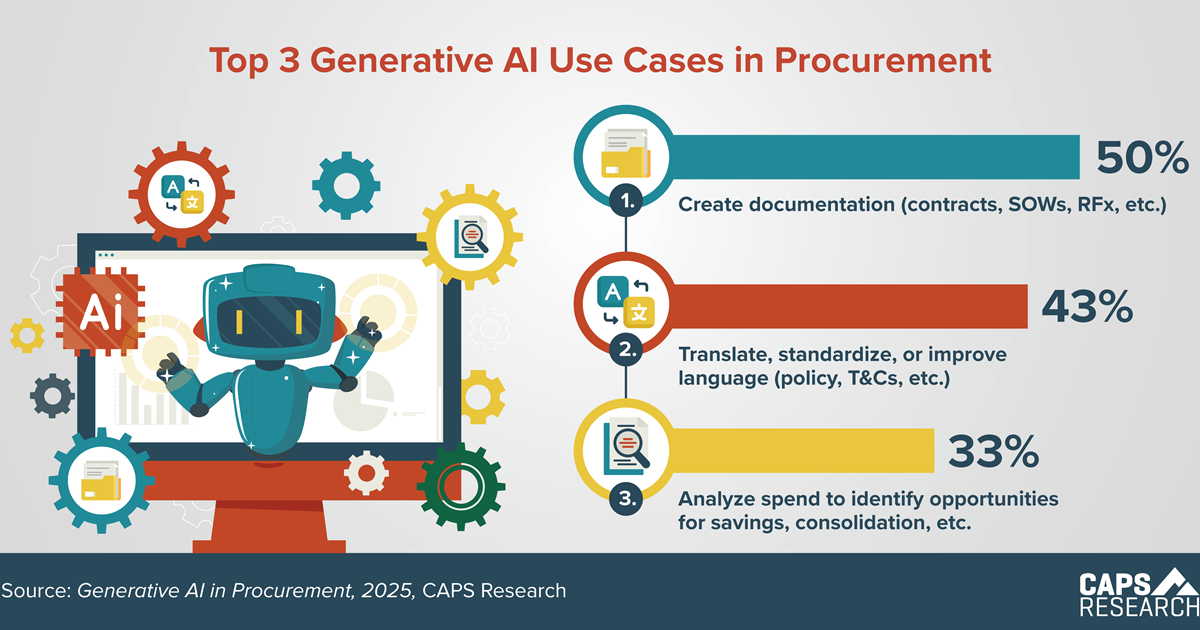

Generative AI Uses

The use of Generative AI in procurement has increased by 15% in the past year, mostly for creating documentation; translating, standardizing, or improving language; as well as analyzing spend to identify opportunities for savings or consolidation. With most organizations spending under $10,000 for AI adoption, it is proving to be a cost-effective time saver.

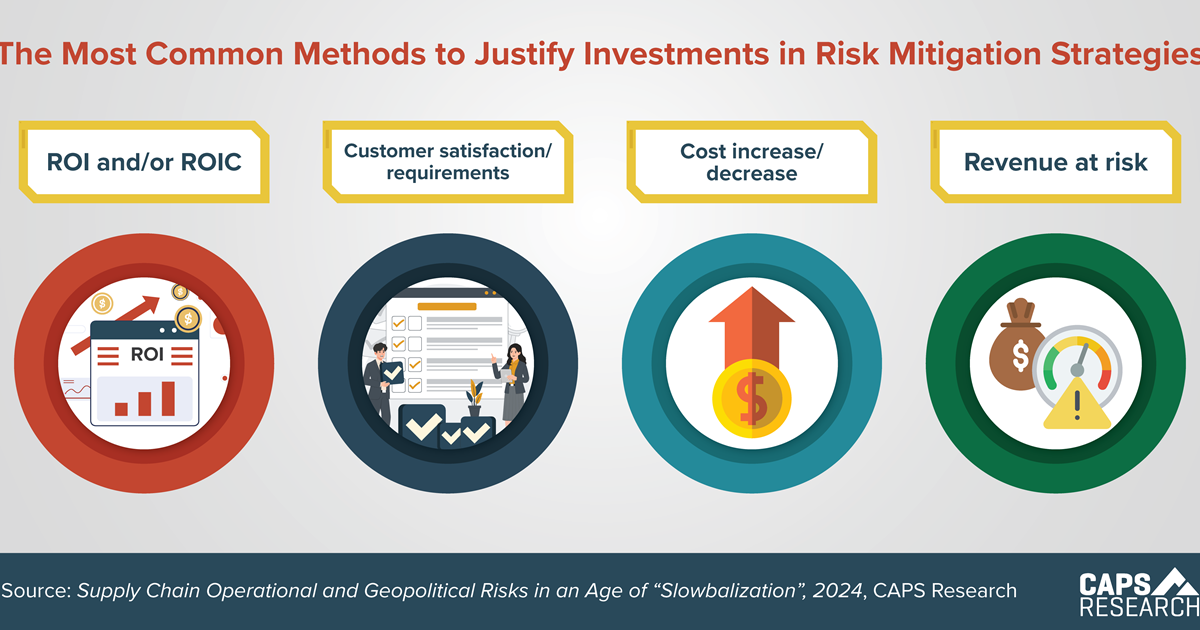

Investments in Risk Mitigation

The most common methods that supply chain executives justify their investment in risk mitigation strategies are with ROI estimates, customer satisfaction, impact on cost, and revenue dollars at risk. Authorizing costly risk mitigation expenses is one of the primary challenges for executives, particularly when they are only potential risks.

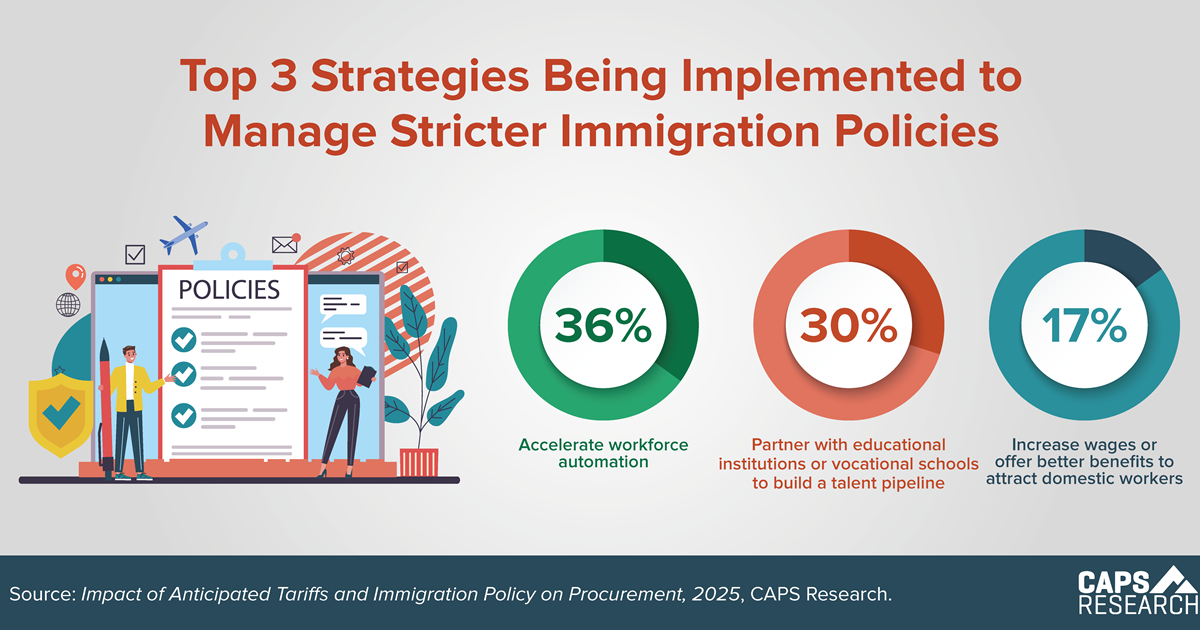

Managing Immigration Policies

Organizations are currently implementing a number of strategies to manage the potential impacts of stricter immigration policies. These strategies include accelerating workforce automation, partnering with educational institutions to build a talent pipeline, and increasing wages.

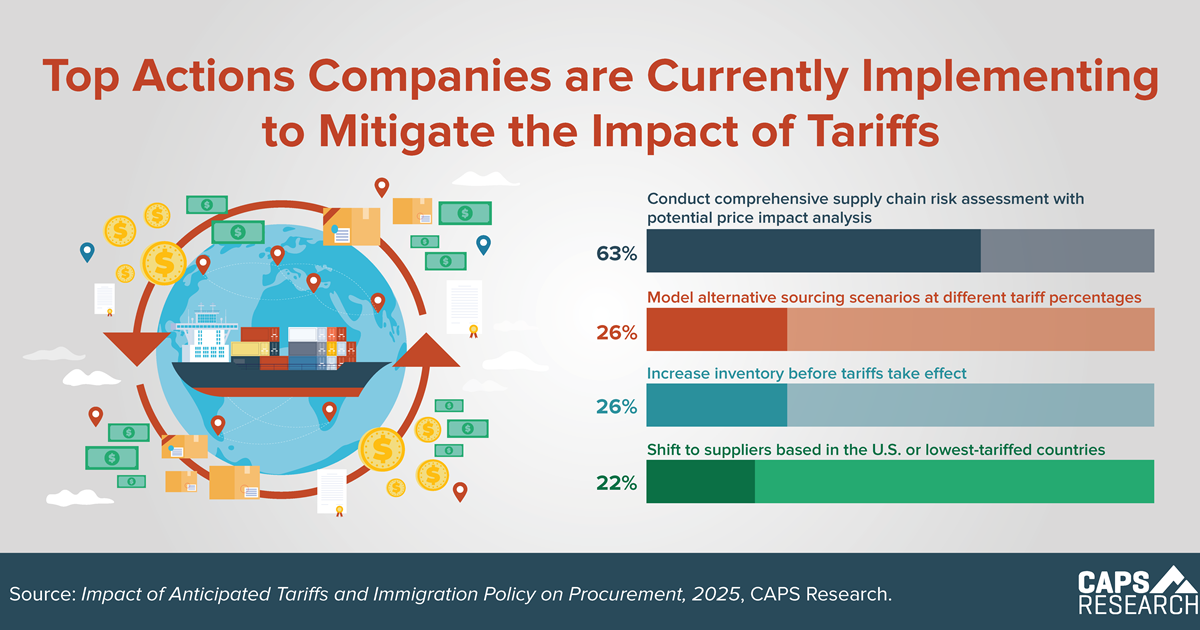

Mitigating Tariff Impacts

Companies are currently implementing a number of actions in order to mitigate the impact of potential new tariffs. The leading action companies are currently taking is conducting comprehensive supply chain risk assessments with potential price impact analysis (63%). These risk assessments are crucial for procurement/SCM professionals to help ensure business continuity and understand potential financial risks to the company.

Non-members can receive the report of each survey they submit.

Members can access all reports, but are encouraged to submit surveys to

increase the comparative breakouts only they receive.